Summary of RCM Liability/ITC Statement Introduction on GST Portal

If a person has paid the Reverse Charge Mechanism (RCM) liability but has not yet claimed the Input Tax Credit (ITC) under RCM as of July 2024, they need to report the opening balance of the RCM liability in the designated table.

Effective Date:

- Applicable from August 2024 for monthly filers.

- Applicable from the July-September 2024 quarter for quarterly filers.

Purpose:

- To enhance accuracy and transparency in reporting Reverse Charge Mechanism (RCM) transactions.

- Captures RCM liability from Table 3.1(d) and corresponding ITC from Tables 4A(2) and 4A(3) of GSTR-3B.

Access:

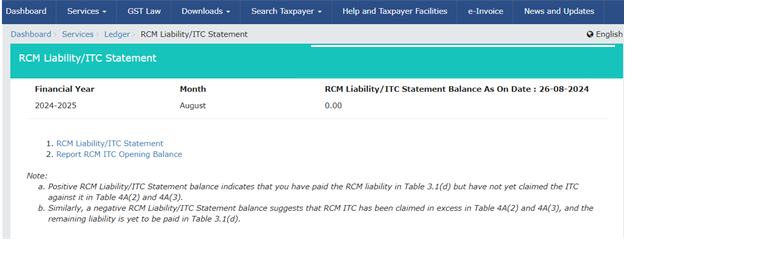

- Navigate to: Services >> Ledger >> RCM Liability/ITC Statement.

Reporting Opening Balance:

Navigation:

-

- Login >> Report RCM ITC Opening Balance or

- Services >> Ledger >> RCM Liability/ITC Statement >> Report RCM ITC Opening Balance.

- For Excess RCM Liability without Corresponding ITC:

- Report positive value as RCM ITC opening balance.

- For Excess RCM ITC without Corresponding Liability:

- Report negative value as RCM ITC opening balance.

- Reclaiming Reversed RCM ITC:

- Reclaim through Table 4A(5) of GSTR-3B, not through Tables 4A(2) and 4A(3).

- Reversed RCM ITC does not need to be reported as RCM ITC opening balance.

Reconciliation Timeline:

- Monthly Filers: Reconcile and report RCM ITC till the July 2024 return period.

- Quarterly Filers: Reconcile and report RCM ITC up to Q1 of FY 2024-25, considering the April-June 2024 return period.

Deadlines:

- Opening Balance Declaration: By 31.10.2024.

- Amendments to Opening Balance: Allowed until 30.11.2024. Three opportunities to amend are provided.

Note:

- The facility for amendments will be discontinued after 30.11.2024.