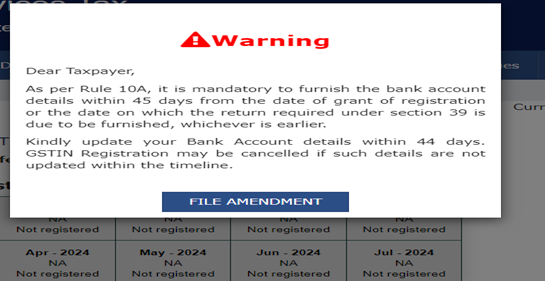

Under Rule 10A of the Central Goods and Services Tax Rules, 2017, as updated by Notification No. 31/2019 dated June 28, 2019, taxpayers must provide details of a valid bank account within 30 days of receiving their GST registration. Alternatively, they must do so before submitting details of outward supplies in FORM GSTR-1 or through the Invoice Furnishing Facility (IFF), whichever comes first.

Starting September 1, this rule is effective

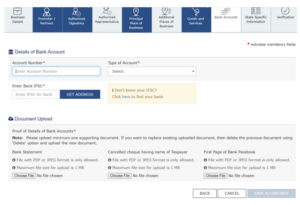

To comply, follow these steps to submit your bank details under GST:

Click to file amendment

Provide Bank Details: In the amendment form, fill in the details of your valid bank account

Submit the Amendment: After entering the required information, submit the amendment form for review. Add new and submit the detail