Important GST Portal Update for Taxpayer(for input claim under section 16(4))

Goods and service Tax (GSTN) has “Enabled Filing of Application for Rectification of Demand Orders” (as per Notification No. 22/2024-CT, dated 08.10.2024, issued following the 54th GST Council recommendations) over the GST Portal.

Dated: 07/01/2025

Application for Rectification of Demand Orders:

Registered persons with demand orders confirming wrongful ITC availment under Section 16(4) can now apply for rectification if such ITC is eligible under newly inserted Section 16(5) and/or 16(6).

Key Highlights of the GST Portal enable Functionality is below:

GST Portal Functionality Enabled:

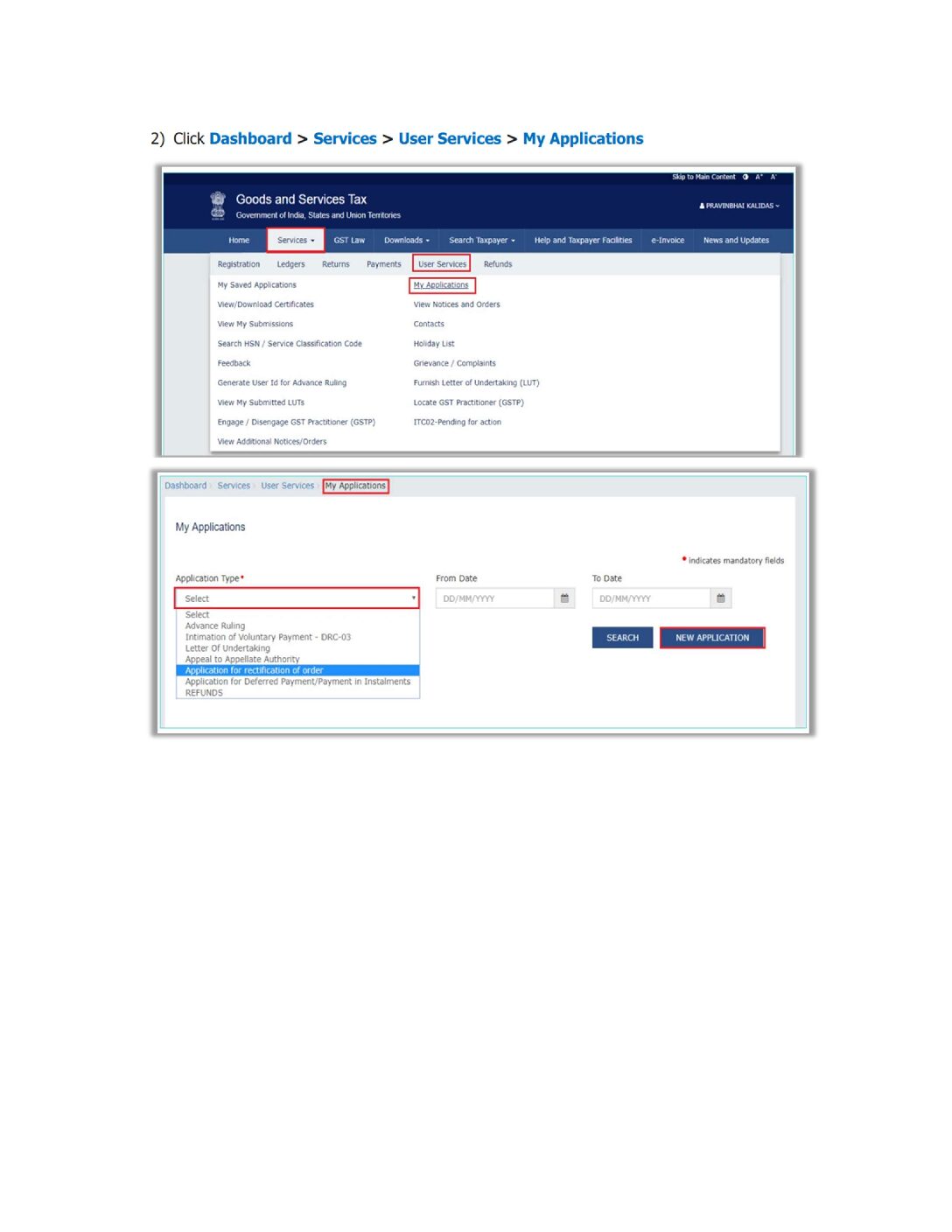

Navigate to: Services > User Services > My Applications >, then Select: “Application for Rectification of Order” > then Click “NEW APPLICATION”

Supporting Documents:

Download and fill Annexure A (available in Word format).

Upload details of the demand order during application submission.

Step-by-Step Guide:

Access the det

If the order issue under Section 73/74 and the appeal was not filed by the tax payer________________

Here’s a quick breakdown of Section 16(4), 16(5) and 16(6):

Section 16(4):

ITC can be claimed only until 30th November following the end of the financial year to which the invoice or debit note pertains OR before filing the annual return, whichever is earlier.

Section 16(5):

For invoices related to FY 2017-18 to 2020-21, ITC could be claimed in returns filed up to 30th November 2021.

Section 16(6):

If a taxpayer’s GST registration is cancelled and later revoked by an authority, tribunal, or court, they are allowed to claim Input Tax Credit (ITC) on invoices or debit notes, provided ITC was not restricted for the cancellation date.

The ITC can be claimed in returns filed by 30th November following the financial year of the invoice or before the annual return, whichever is earlier. Alternatively, ITC can also be claimed for the period between cancellation and revocation, if the return is filed within 30 days of revocation.