Manual on Invoice Management System (IMS)

Introduction

The Invoice Management System (IMS) is a significant advancement in the Goods and Services Tax (GST) ecosystem, designed to enhance how taxpayers manage invoices. This innovative feature allows recipients to easily accept, reject, or keep invoices pending, streamlining reconciliation and improving GST compliance.

Starting from 14th October, taxpayers can access this system on the GST portal. While it is not mandatory to take action on invoices for GSTR-2B generation, any invoices left unaddressed will be automatically accepted by the system.

Accessing the IMS

- Go to gst.gov.in and log in with your credentials.

- Navigate to Services > Returns > Invoice Management System (IMS).

Dashboard Overview

The IMS dashboard comprises two main sections:

- Inward Supplies: View and act on invoices reported by suppliers.

- Outward Supplies: Check the status of outward supplies based on recipient actions.

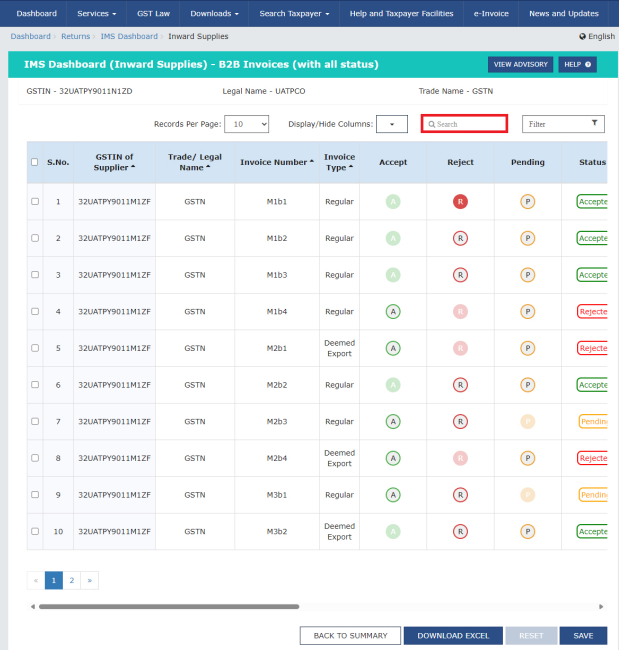

Managing Inward Supplies

Viewing Inward Supplies

- Click the VIEW button under the Inward Supplies tile.

- A prompt will inform you that invoices with no action will be treated as accepted. Click OKAY to proceed.

- A summary page will display all inward supplies, categorized into various sections.

Taking Action on Invoices

- Categories:

- No Action: Invoices saved by the supplier with no action taken by the recipient.

- Accepted: Invoices accepted by the recipient.

- Rejected: Invoices rejected by the recipient.

- Pending: Invoices marked for future action.

Filters and Search

You can filter records based on GSTIN, invoice type, date, and other criteria. Use the search function to quickly locate specific invoices.

Action Buttons

For each invoice, you can choose:

- A: Accept

- R: Reject

- P: Mark as Pending

Bulk Actions

To select multiple records:

- Check the box in the header to select all records on the page or all pages.

- Click PROCEED to take action on the selected invoices.

Downloading Data

You can download invoice details in Excel format by clicking the DOWNLOAD EXCEL button.

Resetting Actions

If you wish to undo any actions taken, click the RESET button to revert to previous states.

Managing Outward Supplies

Viewing Outward Supplies

- Click the VIEW button under Outward Supplies.

- Select the financial year and return period, then click SEARCH.

Exploring Outward Supplies

You can view and filter B2B supplies reported in GSTR-1/IFF/GSTR-1A. Clicking on the descriptions will reveal more details.

Generating GSTR-2B

The system automatically generates a draft GSTR-2B on the 14th of the following month. If no actions have been taken, this draft will be final. However, if any actions are taken, you will need to recompute GSTR-2B before filing GSTR-3B by clicking the COMPUTE GSTR-2B button.

Conclusion

The Invoice Management System is a transformative tool for taxpayers, enhancing efficiency and accuracy in managing GST obligations. By familiarizing yourself with this manual, you can leverage the full potential of IMS to streamline your invoice management processes. For further assistance, please refer to the HELP section on the GST portal.